Discover the Perks of Getting a Reverse Home Loan Today

As retirement strategies, many home owners face the difficulty of handling expenses while preserving their top quality of life. A reverse mortgage provides a viable service, permitting people aged 62 and older to convert their home equity into cash money, thus minimizing economic problems without requiring regular monthly settlements. This financial instrument not only supplies access to crucial funds however additionally uses the potential to improve general health in retired life. However, comprehending the nuances and ramifications of this alternative is crucial, as it may substantially influence future economic security. What factors should one consider prior to making such a choice?

What Is a Reverse Home Mortgage?

A reverse home mortgage is a monetary item created to help homeowners aged 62 and older faucet into their home equity without needing to offer their home. This unique financing enables eligible homeowners to convert a portion of their home equity into cash money, which can be utilized for numerous functions, consisting of covering living expenses, medical care costs, or home adjustments.

Unlike standard home mortgages, where month-to-month settlements are made to the lender, reverse mortgages require no monthly repayment. Instead, the car loan is paid back when the house owner offers the home, moves out, or passes away.

There are a number of sorts of reverse home loans, consisting of Home Equity Conversion Home Mortgages (HECM), which are government guaranteed. Qualification is based on the property owner's age, home equity, and creditworthiness. This monetary tool offers a practical option for seniors looking for economic adaptability while remaining in their homes, making it a progressively prominent option among retirees.

Financial Independence in Retired Life

Attaining monetary self-reliance in retirement is a goal for several elders, and reverse home loans can play a critical duty in this quest. This monetary instrument permits house owners aged 62 and older to convert a portion of their home equity right into money, offering a steady revenue stream without the responsibility of monthly home mortgage payments.

For retirees, preserving economic freedom often pivots on having access to sufficient sources to cover unforeseen costs and day-to-day costs. A reverse home mortgage can assist bridge the space in between fixed revenue sources, such as Social Security and pension plans, and rising living costs, consisting of health care and residential property taxes. By using the equity in their homes, seniors can improve their cash money flow, permitting them to live even more conveniently and with better safety and security.

In addition, reverse mortgages can equip senior citizens to choose that line up with their way of life goals, such as moneying travel, involving in leisure activities, or supporting relative - purchase reverse mortgage. With careful planning and factor to consider, a reverse home mortgage can serve as a useful device, enabling retirees to accomplish their preferred lifestyle while maintaining their independence and dignity throughout their retired life years

Accessing Home Equity

Homeowners aged 62 and older have an one-of-a-kind opportunity to access a significant section of their home equity via reverse mortgages, enhancing their monetary versatility in retirement. This monetary product enables eligible senior citizens to convert a part of their home equity right into money, supplying funds that can be made use of for numerous objectives, such as medical care expenditures, home modifications, or daily living costs.

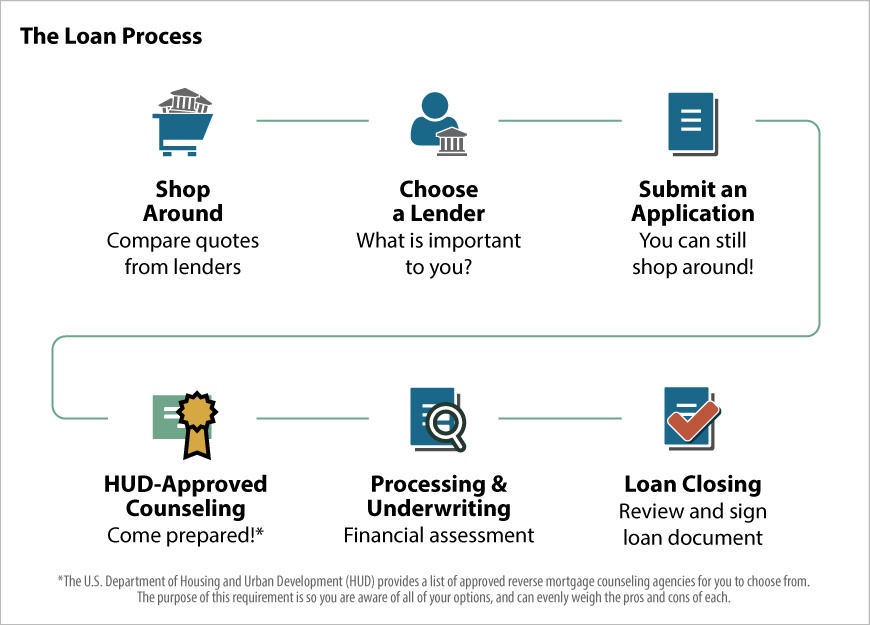

The process of obtaining a reverse mortgage usually includes an uncomplicated application and authorization approach. When protected, house owners can get their equity in a number of forms, including a lump amount, month-to-month repayments, or a credit line. This adaptability enables retired people to tailor their funding according to their details needs and scenarios.

Significantly, reverse home loans are non-recourse car loans, implying that borrowers will certainly never ever owe greater than the value of their home at the time of repayment, also if the loan equilibrium surpasses that value. This attribute uses assurance, ensuring that retired life savings are protected. Thus, accessing home equity with a reverse mortgage can act as an important financial method, enabling older grownups to take pleasure in a more comfy and secure retired life while leveraging the riches bound in their homes.

Eliminating Regular Monthly Home Mortgage Repayments

Among the most considerable benefits of a reverse mortgage is the removal of month-to-month mortgage repayments, giving property owners with prompt financial relief. This function is specifically useful for senior citizens or those on a fixed earnings, as it alleviates the problem of regular monthly financial commitments. By transforming home equity right into accessible funds, house owners can reroute their sources in the direction of crucial living expenses, healthcare, or personal endeavors without the tension of preserving routine home loan repayments.

Unlike conventional home loans, where regular monthly repayments contribute to the primary balance, reverse mortgages operate on a different concept. Home owners preserve possession of their residential or commercial property while building up passion on the finance quantity, which is only paid back when they sell the home, vacate, or die. This one-of-a-kind setup enables individuals to remain in their homes much longer, boosting monetary stability throughout retired life.

Furthermore, the absence of monthly mortgage settlements can dramatically enhance money flow, making it possible for home owners to handle their budgets more properly. This monetary flexibility encourages them to make much better lifestyle selections, purchase opportunities, or merely delight in a more comfy retirement without the consistent concern of home loan payment responsibilities (purchase reverse mortgage). Thus, the removal of regular monthly settlements attracts attention as an essential advantage of reverse home loans

Enhancing Lifestyle

A substantial benefit of reverse home loans is their ability to substantially enhance the lifestyle for retirees and older house owners. By Continued converting home equity into accessible money, these financial products give a crucial resource for handling everyday expenses, medical costs, and Go Here unexpected expenses. This economic versatility enables seniors to maintain their preferred criterion of living without the burden of regular monthly home mortgage settlements.

Additionally, reverse home loans can encourage homeowners to pursue personal rate of interests and leisure activities that may have been formerly unaffordable. Whether it's traveling, taking courses, or taking part in social activities, the extra revenue can promote a much more meeting retired life experience.

Moreover, reverse home mortgages can be instrumental in dealing with healthcare needs. Many senior citizens face increasing clinical expenses, and having extra funds can help with timely therapies, medications, or even home modifications to accommodate flexibility challenges.

Verdict

Unlike standard home loans, where regular monthly payments are made to the loan provider, reverse home loans need no regular monthly repayment.There are several kinds this post of reverse home loans, consisting of Home Equity Conversion Home Mortgages (HECM), which are government insured. Accessing home equity through a reverse home loan can offer as an important monetary technique, allowing older grownups to delight in an extra secure and comfy retirement while leveraging the wealth connected up in their homes.

One of the most considerable benefits of a reverse home loan is the removal of month-to-month mortgage repayments, providing house owners with immediate financial relief.Unlike conventional home mortgages, where monthly payments add to the primary balance, reverse home loans operate on a various concept.